Market | Crypto

Current risk Level

Yellow: elevated risk of crisis in the financial market. he incidence of a crisis is somewhat higher than usual. (Updated Apr. 2024).

Timeline

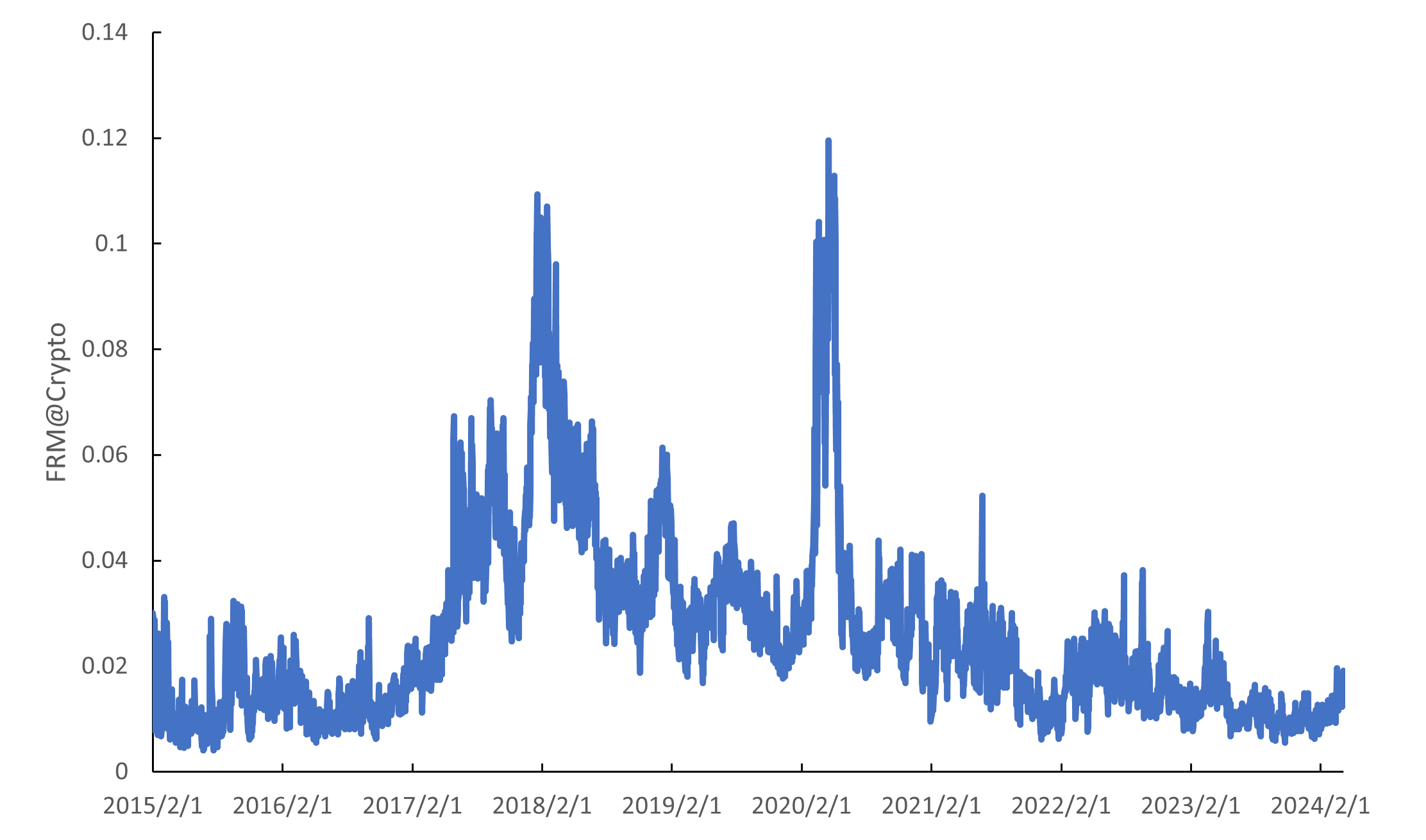

The Crypto FRM captures the systemic tail event behavior in the largest 15 crypto coins by amount outstanding but focusing on a more recent trading period given the availability of data. We start our analysis in 2015 with 8 crypto currencies and extend it to 15 from July 2017 onwards. The 2018 cryptocurrency crash is well captured after the rapid rise in crypto coins in 2017. Similarly, the drop in Bitcoin prices at the end of 2018 led to another increase in systemic tail event risk.

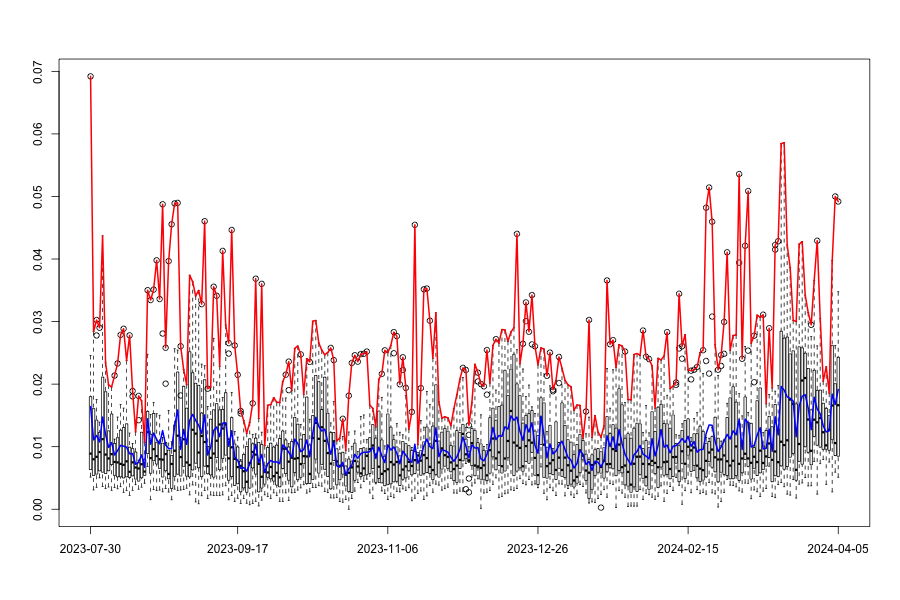

The animation below represents the network of constituents in the Crypto network – specifically the interplay between coins and where risk is concentrated. Edges in the graph are directional, as indicated by the arrows. Notice the marginal return contribution from the highlighted crypto (BTC) to one or more nodes and that from other nodes to it.

What This Is About:

The Financial Risk Meter (FRM) is a novel risk measure used to identify different systemic risk levels in the financial markets over time. It is an index of the system volatility level, thus if FRM is high, then the systemic risk is also high.

Details:

We propose a linear lasso measure to estimate systemic interconnectedness across financial institutions based on tail-driven spill-over effects in an ultra-high dimensional framework. Methodologically, we employ a variable selection technique in a time series setting for a linear quantile regression framework with 5% quantile. We can thus include more financial institutions into the analysis, to measure their interdependencies in the distribution tails.

Then FRM is induced from this model which is the averaged tuning parameter lambda from the lasso technique.

Risk Levels Explained

Red: severe risk of a crisis in the financial market. Our risk measure suggests that a financial crisis is imminent or happening right now. This risk level is given for lambda values higher than the 80%-ratio.

Orange: high risk of crisis in the financial market. A crisis might occur very soon. This risk level is given for lambda values between the 60%-ratio and 80%-ratio.

Yellow: elevated risk of crisis in the financial market. The incidence of a crisis is somewhat higher than usual. This risk level is given for lambda values between the 40%-ratio and 60%-ratio.

Blue: general risk of crisis in the financial market. There is no specific risk of a crisis. This risk level is given for lambda values between the 20%-ratio and 40%-ratio.

Green: low risk of crisis in the financial market. The incidence of a crisis is less likely than usual. This risk level is given for lambda values lower then the 20%-ratio.

References

Ideas, papers, theory and code used in this project:

Financial Risk Meter For The Romanian Stock Market (2023)

Romanian Journal of Economic Forecasting

Pele DT, Conda AL, Bag RC, Mazurencu-Marinescu-Pele M, Strat VA

Applied Economics, Systemic Risk and Financial System Network using Financial Risk Meter: The Case of Vietnam (2023)

Applied Economics

Nguyen PA, Nguyen NP, Le HMD

Assessing Network Risk with FRM: Links with Pricing Kernel Volatility and Application to Cryptocurrencies (2023)

Quantitative Finance

Wang R, Potì V, Härdle WK

A Financial Risk Meter for China (2023)

Emerging Markets Review

Wang R, Althof M, Härdle WK

Financial Risk Meters in Taiwan, Working Paper (2023)

Teng HW, Jheng SL, Chen JY, Tang CY, Tsai HY, Härdle WK

Financial Risk Meter FRM based on Expectiles (2022)

Journal of Multivariate Analysis

Ren R, Lu MJ, Li Y, Härdle WK

Financial Risk Meter for Cryptocurrencies and Tail-Risk Network Based Portfolio Construction (2022)

The Singapore Economic Review

Ren R, Althof M, Härdle WK

Financial Risk Meter for emerging markets (2022)

Research in International Business and Finance

Amor SB, Althof M, Härdle WK

FRM Financial Risk Meter (2020)

The Econometrics of Networks

Mihoci A, Althof M, Chen CYH, Härdle WK

An AI approach to Measuring Financial Risk (2020)

Singapore Economic Review

Yu L, Härdle WK, Borke L, Benschop T

LASSO-Driven Inference in Time and Space (2021)

The Annals of Statistics

Chernozhukov V, Härdle WK, Huang C, Wang W

Single-index-based CoVaR with Very High-Dimensional Covariates (2018)

Journal of Business & Economic Statistics

Fan Y, Härdle WK, Wang W, Zhu L

TENET: Tail-Event driven NETwork risk (2016)

Journal of Econometrics

Wolfgang Karl Härdle, Weining Wang, Lining Yu