Market | Chinese Mainland

Current risk Level

Orange: high risk of crisis in the financial market. A crisis might occur very soon. This risk level is given for lambda values between the 60%-ratio and 80%-ratio. (Updated Feb.2024)

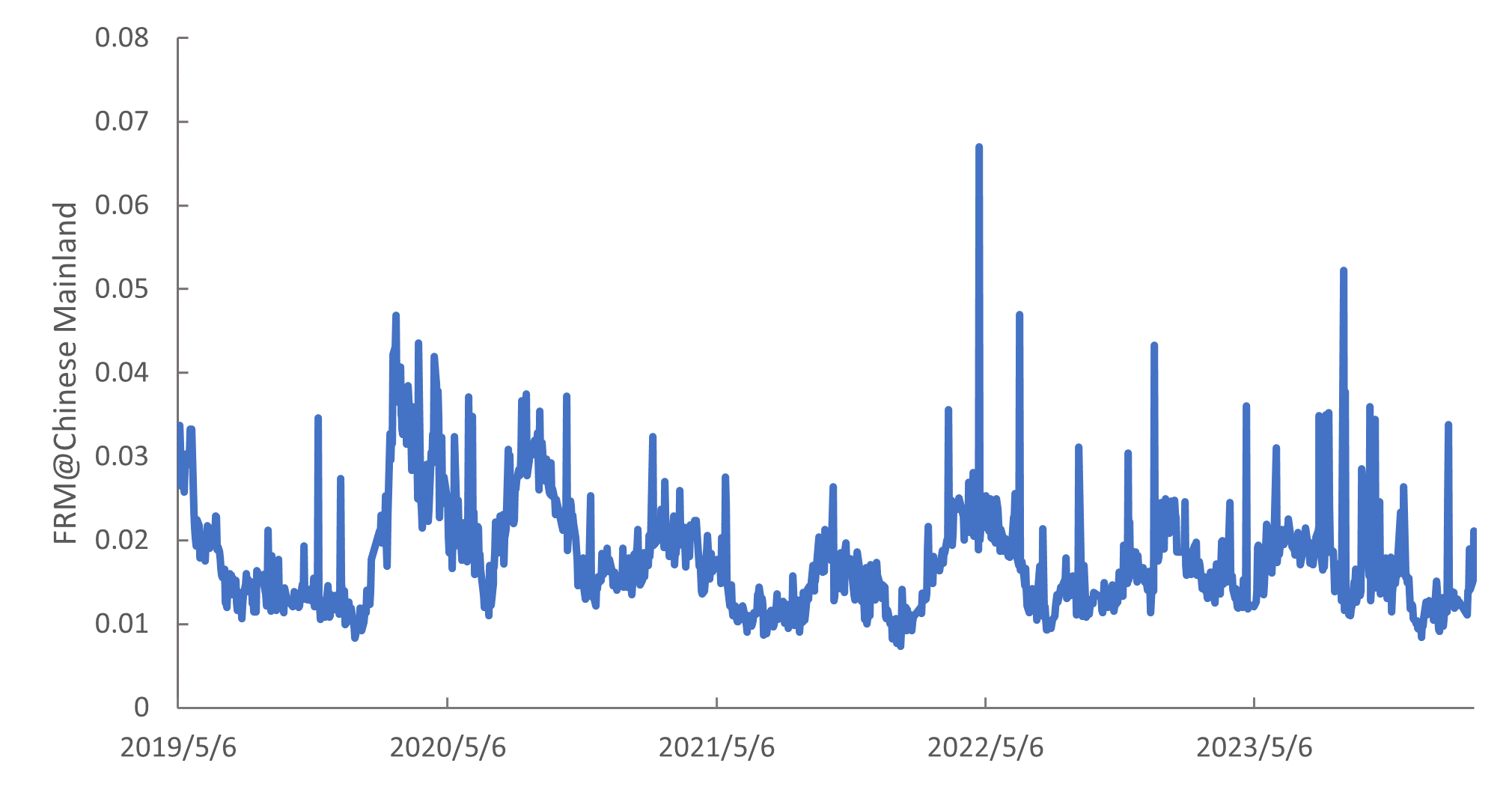

Timeline

FRM@Chinese Mainland captures the systemic tail event behavior based on 125 Financial Institutions listed in Chinese Mainland, which are traded on the stock exchanges in Shanghai and Shenzhen. The trade and financial flow between these markets has recently reached new highs, thus the risk of spillover between them has also increased.

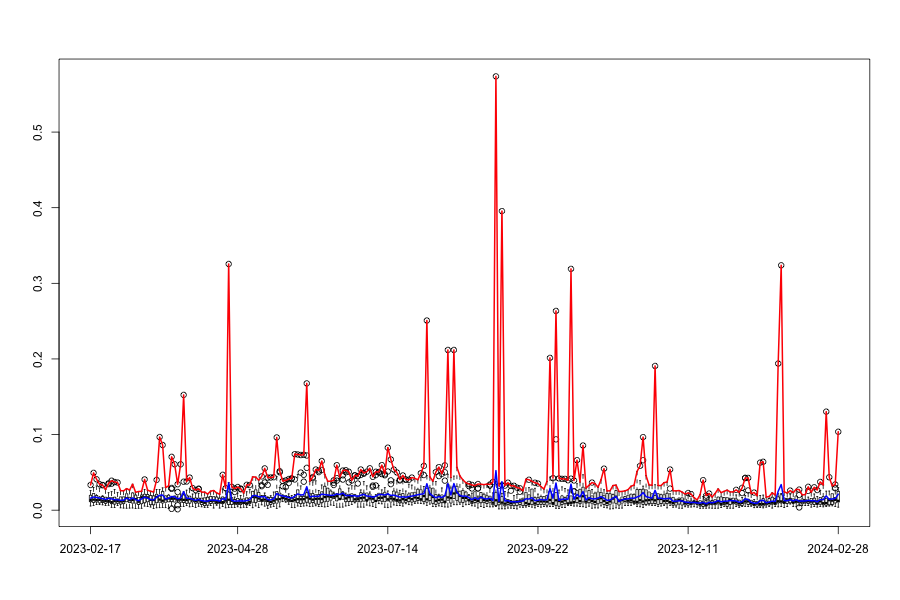

Using the adjacency matrix we can describe the network dynamic and behavior between companies listed on the 2 stock exchanges (Shanghai and Shenzhen) as shown in the figure below:

What This Is About:

The Financial Risk Meter (FRM) is a novel risk measure used to identify different systemic risk levels in the financial markets over time. It is an index of the system volatility level, thus if FRM is high, then the systemic risk is also high.

Details:

We propose a linear lasso measure to estimate systemic interconnectedness across financial institutions based on tail-driven spill-over effects in an ultra-high dimensional framework. Methodologically, we employ a variable selection technique in a time series setting for a linear quantile regression framework with 5% quantile. We can thus include more financial institutions into the analysis, to measure their interdependencies in the distribution tails.

Then FRM is induced from this model which is the averaged tuning parameter lambda from the lasso technique.

Risk Levels Explained

Red: severe risk of a crisis in the financial market. Our risk measure suggests that a financial crisis is imminent or happening right now. This risk level is given for lambda values higher than the 80%-ratio.

Orange: high risk of crisis in the financial market. A crisis might occur very soon. This risk level is given for lambda values between the 60%-ratio and 80%-ratio.

Yellow: elevated risk of crisis in the financial market. The incidence of a crisis is somewhat higher than usual. This risk level is given for lambda values between the 40%-ratio and 60%-ratio.

Blue: general risk of crisis in the financial market. There is no specific risk of a crisis. This risk level is given for lambda values between the 20%-ratio and 40%-ratio.

Green: low risk of crisis in the financial market. The incidence of a crisis is less likely than usual. This risk level is given for lambda values lower then the 20%-ratio.

NFT Art

What are NFTs? NFTs are Digital tokens that provides proof of ownership and authenticity for assets.

What do they change? They are a new and fast way of digital art trading, see for example collections such as CryptoPunks, Art Blocks, etc.

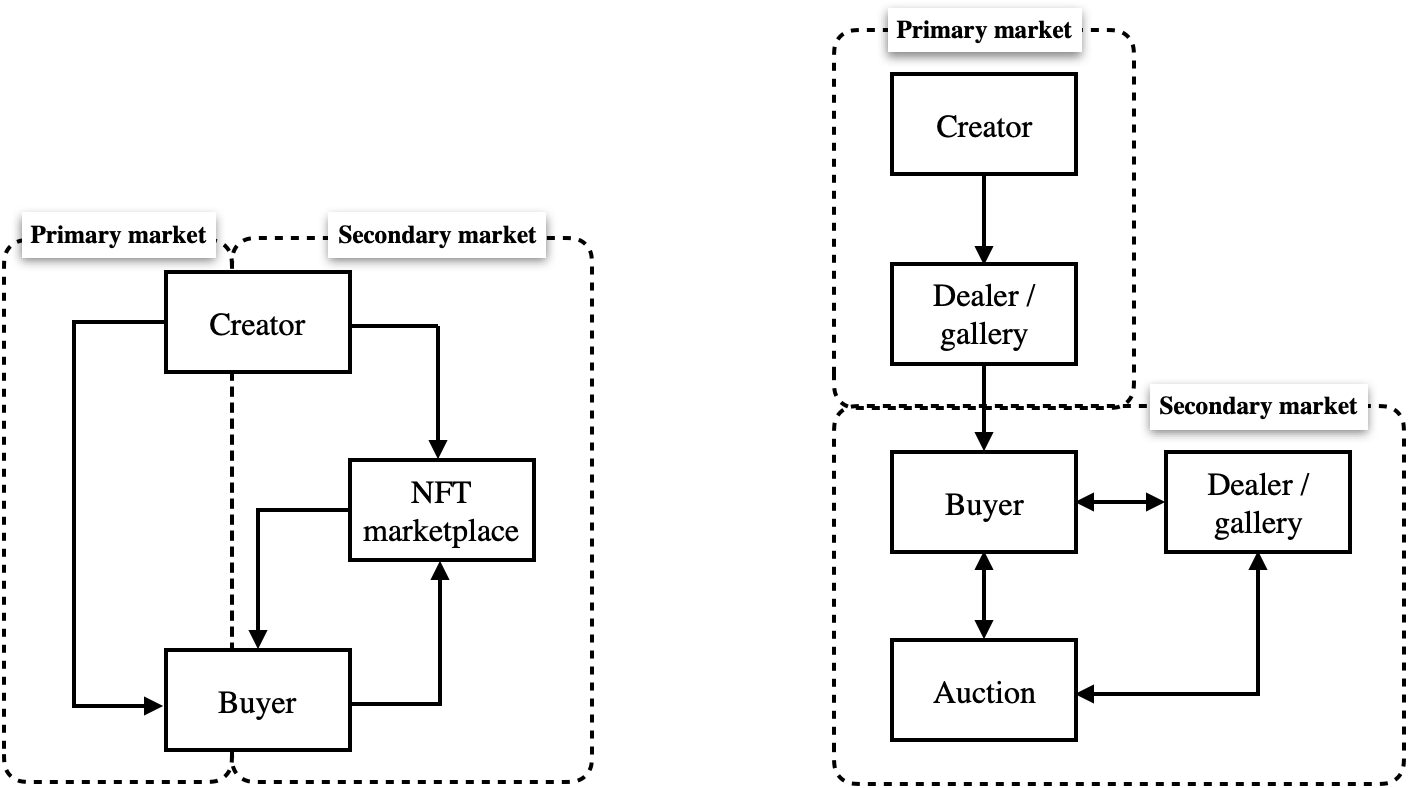

NFT Art Market

- Initial sale and price determined by the creator

- Most trades occur on platforms like Opensea and Rarible

- Subsequent transactions are traceable

Conventional Art Market

- Creators in traditional art markets rely on dealers/galleries for sales

- Prices are determined through valuation and negotiation

References

Ideas, papers, theory and code used in this project:

Financial Risk Meter For The Romanian Stock Market (2023)

Romanian Journal of Economic Forecasting

Pele DT, Conda AL, Bag RC, Mazurencu-Marinescu-Pele M, Strat VA

Applied Economics, Systemic Risk and Financial System Network using Financial Risk Meter: The Case of Vietnam (2023)

Applied Economics

Nguyen PA, Nguyen NP, Le HMD

Assessing Network Risk with FRM: Links with Pricing Kernel Volatility and Application to Cryptocurrencies (2023)

Quantitative Finance

Wang R, Potì V, Härdle WK

A Financial Risk Meter for China (2023)

Emerging Markets Review

Wang R, Althof M, Härdle WK

Financial Risk Meters in Taiwan, Working Paper (2023)

Teng HW, Jheng SL, Chen JY, Tang CY, Tsai HY, Härdle WK

Financial Risk Meter FRM based on Expectiles (2022)

Journal of Multivariate Analysis

Ren R, Lu MJ, Li Y, Härdle WK

Financial Risk Meter for Cryptocurrencies and Tail-Risk Network Based Portfolio Construction (2022)

The Singapore Economic Review

Ren R, Althof M, Härdle WK

Financial Risk Meter for emerging markets (2022)

Research in International Business and Finance

Amor SB, Althof M, Härdle WK

FRM Financial Risk Meter (2020)

The Econometrics of Networks

Mihoci A, Althof M, Chen CYH, Härdle WK

An AI approach to Measuring Financial Risk (2020)

Singapore Economic Review

Yu L, Härdle WK, Borke L, Benschop T

LASSO-Driven Inference in Time and Space (2021)

The Annals of Statistics

Chernozhukov V, Härdle WK, Huang C, Wang W

Single-index-based CoVaR with Very High-Dimensional Covariates (2018)

Journal of Business & Economic Statistics

Fan Y, Härdle WK, Wang W, Zhu L

TENET: Tail-Event driven NETwork risk (2016)

Journal of Econometrics

Wolfgang Karl Härdle, Weining Wang, Lining Yu