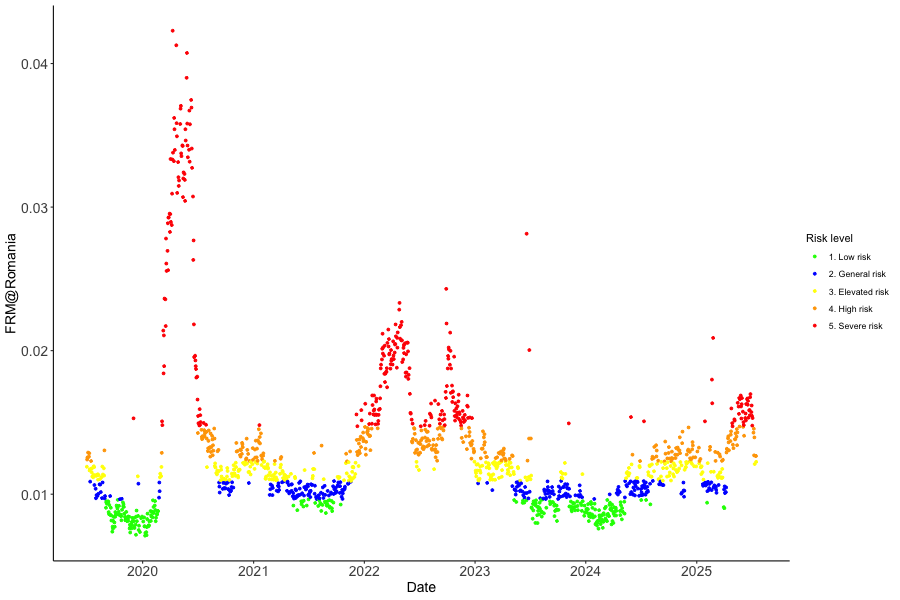

Market | Romania

Current risk Level

Red: severe risk of a crisis in the financial market. Our risk measure suggests that a financial crisis is imminent or happening right now. This risk level is given for lambda values higher than the 80%-ratio. (Updated July 2025)

Timeline

FRM@RO captures the systemic tail event behavior in the Romanian Stock Market, focusing on the most important companies traded at Bucharest Stock Exchange. FRM@RO can properly predict the technical recession between 2009Q1-2009Q2 and 2010Q3, as shown by high values of estimated probabilities. Furthermore, the model gives a signal of potential risk to the economy in 2020Q2 when the Romanian real quarterly GDP (seasonally adjusted) decreased by 11.17%. Although it was not a case of technical recession (two consecutive quarters of quarter-on-quarter GDP contraction), the value of FRM@RO in the first quarter of 2020 can be seen as an early warning indicator of economic contraction in the second quarter of 2020, due to the Covid-19 pandemic.

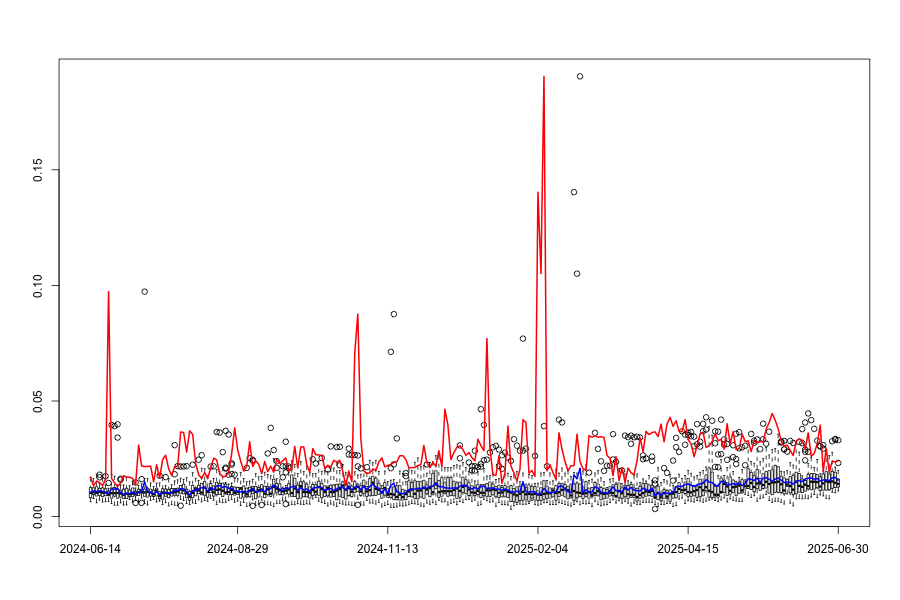

Using the adjacency matrix, we can describe the network behavior and co-movements between the companies listed at BSE (Bucharest Stock Exchange), as seen in the image below.